What are the different national commitments?

According to the United Nations Framework Convention on Climate Change (UNFCCC) Nationally Determined Contributions (NDC) Registry, currently 194 Parties have submitted their first NDCs and 13 Parties have submitted their second NDCs.

The most updated NDC Synthesis Report from this week confirms the worrying trends highlighted in the previous version. Even taking into consideration all available NDCs, we will still witness a temperature rise of about 2.7°C by the end of the century. All the findings point to the inadequacy and lack of urgency of current policies, hence we expect more countries to review their previous NDCs and submit new targets.

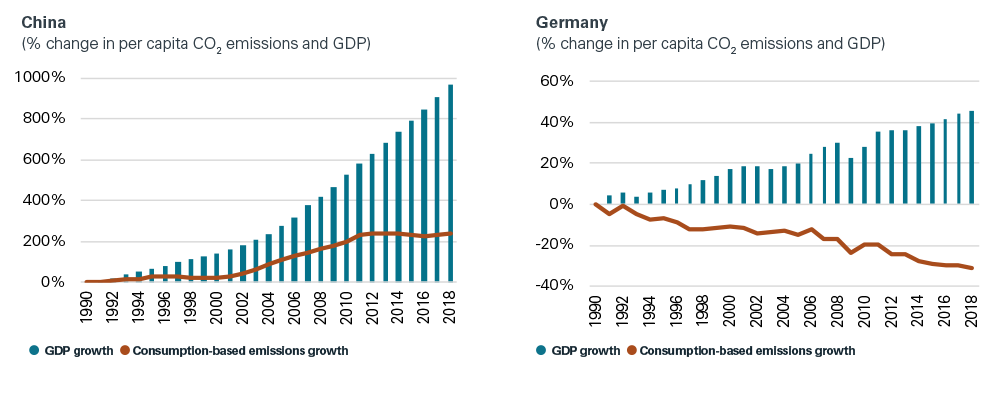

China

Carbon targets in NDC (submitted in September 2016):

- To achieve peaking of CO2 around 2030 and best efforts to peak early

- To increase non-fossil fuels share in primary energy consumption to around 20% by 2030

- To lower CO2 emissions per unit of GDP by 60%-65% from 2005 level by 2030

Net Zero targets:

- Carbon neutrality by 2060, yet to be included in NDC

On the 24th of October 2021, the State Council issued the roadmap to achieve peak CO2 by 2030, which has provided new quantitative and qualitative targets and sectoral guidance. President Xi also announced at the UN General Assembly that China would stop building coal plants abroad. It also launched the carbon trading scheme in July.

President Xi has stated that the country will balance growth and sustainability by focusing more on decarbonisation. The recent announcements are positive after a carbon-intensive recovery and recent increase of coal use but the current policy is still insufficient to reach Paris Agreement goals. China would need to neutralise emissions as early as possible before 2060 and it would also need to set more precise and strict domestic targets.

China has been negotiating with the UK and the U.S. on climate commitment before COP26. However, the political tension and the ongoing trade war between China and the U.S. have made conversations tougher. This week, the EU and China are also meeting in London, and we expect discussions to take place around the Carbon Border Adjustment Mechanism. China is currently Europe’s largest trading partner but it has expressed its concerns that this mechanism would violate trade principles.

United States

Carbon targets in NDC (updated in 2021 after rejoining the Paris Agreement):

- 50-52% reduction of net GHG emissions by 2030 vs 2005

Net Zero targets:

- Net zero by no later than 2050

The administration under President Biden has rejoined the Paris Agreement and stepped up its climate policies and ambitions. The recently announced American Rescue Plan Act also has included several provisions on climate change. Moreover, a second infrastructure bill is underway to be passed. The U.S. Congress is in the process of discussing new legislations and we hope to see progress ahead of COP26. The U.S. does not have a national carbon market currently and it remains unclear whether a carbon tax proposal will be included in the reconciliation bill.

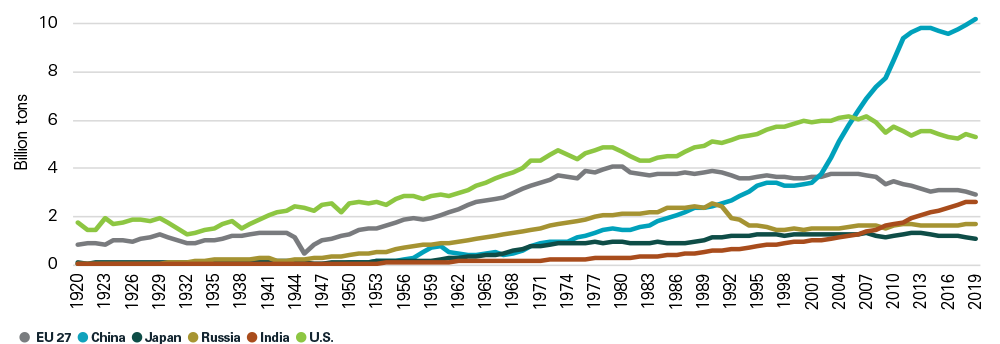

President Biden announced at the UN General Assembly that the U.S. would double its funding to help developing countries in fighting climate change. Furthermore, it has been urging countries such as China and India to update their climate targets. We expect the U.S. to continue negotiating with China to coordinate climate efforts as they are the top emitters in the world.

European Union

Carbon targets in NDC (updated in 2020):

- A net domestic reduction of at least 55% in GHG emissions by 2030 compared to 1990

Net Zero targets:

- Climate neutrality by 2050 stated in its Climate Law

Europe has been the leader in climate change policies and has been focusing on a green recovery from COVID-19 with its Green Deal. It released a Fit-for-55 package in July providing more details on how to reach climate neutrality. These include tightening carbon allowances, broadening scope of ETS to include more sectors and energy taxation directives. Europe is also at the forefront of Sustainable Finance with SFDR, EU Taxonomy and CSRD to provide a comprehensive framework to sustainable investing. Nonetheless, Europe would need to ensure climate policies including coal phase-out are implemented in a timely manner at member state level. This week, the member states are meeting to discuss about reforming the energy market with a big divide between two blocks. Europe will need to make sure any short-term manoeuvres do not compromise the climate neutrality goal.

We expect Europe, together with the UK, to lead some discussions at COP26 and exert further pressure on other countries to step up their funding.

What is the outlook for carbon markets?

Carbon pricing at a sufficiently high level is one of the climate change pillars. Art 6 of the Paris Agreement, with the ambition to set a global carbon trading mechanism, will be a fundamental discussion in relation to international cooperation on climate efforts. According to World Bank data, currently there are 64 carbon pricing initiatives around 45 national jurisdictions and they cover 11.65 GtCO2e, representing 21.5% of global GHG emissions.

EU Emission Trading Scheme (ETS) is among the largest carbon markets in the world, which covers around 40-45% of the EU’s total GHG emissions and it is expanding its scope. Recently we have seen a spike in carbon prices, mainly due to the current energy crisis and new developments of the EU Green Deal including “Fit for 55” package. Nonetheless, the data from Bloomberg New Energy Finance (BNEF) on European Union Allowances (EUA) price in comparison to Northwest Europe carbon fuel-switching price range show that we are still far from the price level which would encourage a wider switch from coal to natural gas.

China launched its national carbon trading market in July. Similar to the EU ETS, it is a cap-and-trade model, which means companies emitting more than allowed will have to buy carbon credits. The carbon price has been trading around $7.88-$8.76/mt but is expected to increase as China’s current price is among the lowest in the world and the demand for carbon credit will increase, especially after the recent announcement of climate targets.

The IMF has emphasised the importance of carbon pricing as a tool to fight climate change and has proposed an international carbon price floor: a 2030 price floor of $75 a ton for advanced economies, $50 for high-income emerging market economies such as China, and $25 for lower income emerging markets such as India.

A harmonised international carbon trading mechanism will be challenging to reach a consensus at COP26 mainly due to different political interests and the current trade tensions. Voluntary market will continue to grow its role in the international decarbonisation process, especially with more and more companies pledging net zero and therefore buying more offsets. The economist Stiglitz’s recent paper on carbon pricing is warning governments that the current price is not reflective of social cost. We expect more guidance on international carbon markets as part of trade discussions.

We look forward to sharing more of our insights throughout the conference.

Source: Our World in Data

Source: Our World in Data

Source: Our World in Data

Source: Our World in Data

A Roadmap to COP26