Climate Action

Ecofin's climate action capabilities focus on the drive to reduce emissions, and includes both the energy transition and waste transition. These businesses span clean conventional categories such as solar, wind, hydro and batteries, in addition to the electrification of transport, energy efficiency, waste-to-value and waste-to-energy.

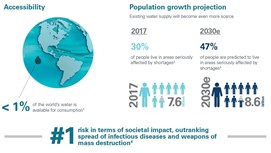

Water & Environment

Ecofin's water and environment capabilities seeks to invest in companies across the globe and throughout the water value chain that we believe are in a position to benefit from the pursuit of solving the water supply/demand imbalance.

Available Through

Social Impact

Ecofin's social impact capabilities provide essential services to communities, including educational services and healthcare services

Available Through

Investment Vehicles

The Sustainability Revolution: What investors should know

The world is aggressively seeking sustainability. While the topic has been around for perhaps a decade, it’s transitioning into a revolution and shepherding an era of conscious capitalism that’s playing out right now across the investment landscape.